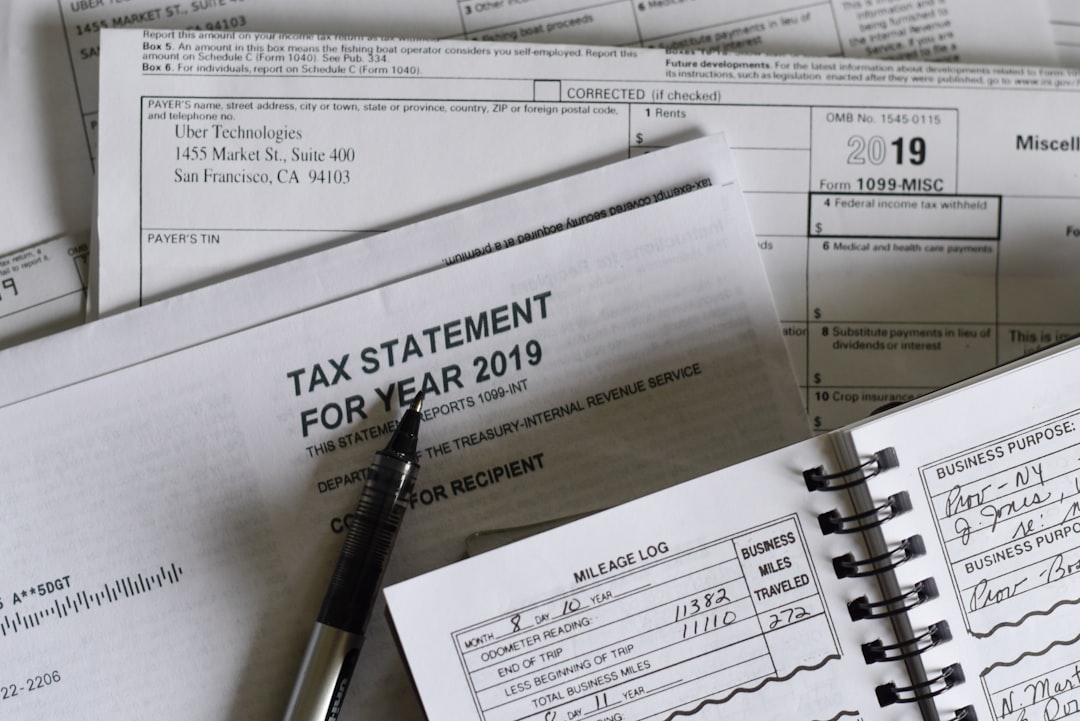

LLC and 1099: Tax Reporting for LLCs

LLC and 1099: Tax Reporting for LLCs Introduction Understanding the relationship between LLCs and 1099 tax forms is crucial for business owners navigating the complexities of tax compliance. Whether you’re an LLC owner receiving 1099 forms from clients or an LLC required to issue 1099s to contractors, proper handling of these tax documents can save … Read more